In the vast realm of real estate, data-driven decisions reign supreme. Property market analysis stands as the compass guiding these decisions, offering a clear perspective on the intricate world of Australian property. However, for beginners, these reports can often seem overwhelming. This guide aims to demystify the layers of Australian property data and provide actionable real estate insights.

Why Market Analysis is Crucial

Understanding the significance of market analysis paves the way for deciphering its content.

1. Informed Investment Decisions

Real estate is a significant investment. An accurate market analysis equips investors with data, ensuring decisions are grounded in reality rather than mere speculation.

2. Price Setting and Negotiation

For sellers, market analysis offers insights into current property values, aiding in setting competitive prices and better negotiation tactics.

3. Predicting Market Trends

Regular engagement with market analysis can help predict upcoming real estate trends, offering an edge in investment strategies.

Key Components of Property Market Analysis

A standard market analysis report is packed with numerous metrics and data sets. To make sense of it all, here’s a breakdown of its key components:

- Comparative Market Analysis (CMA): A snapshot comparing the subject property with similar properties in the vicinity that were recently sold, are currently on sale, or were listings that expired.

- Supply and Demand Metrics: Data showcasing the number of properties available versus the demand in the market, helping gauge market saturation.

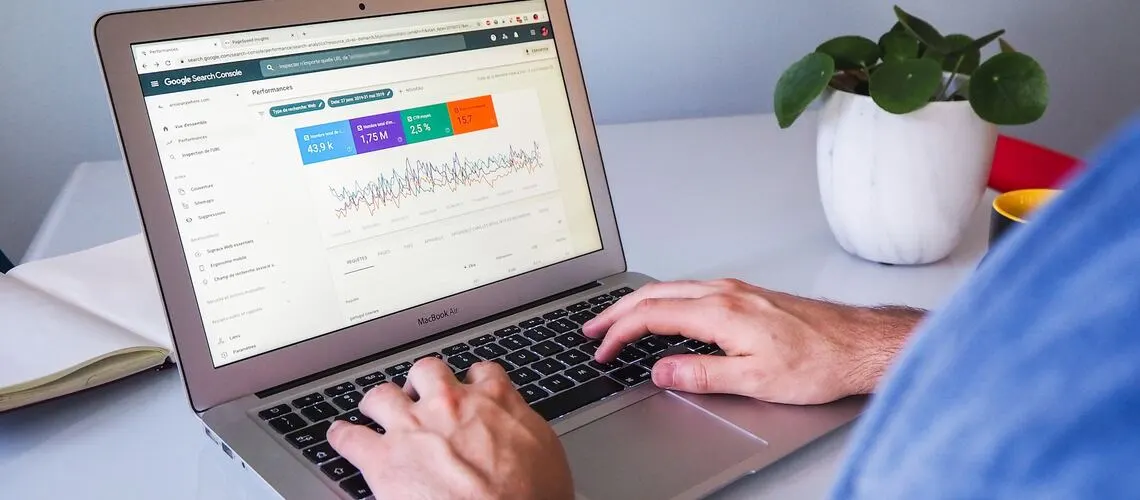

- Historical Data & Trends: Charts and graphs reflecting property value movements and sales trends over a defined period.

- External Factors: Information on factors like infrastructural developments, policy changes, or economic shifts that might influence property values.

Translating Data into Real Estate Insights

Having a comprehensive market analysis in hand is one thing; extracting actionable insights is another.

1. Price Point Identification

By comparing similar properties and understanding market trends, one can identify the most competitive price points for buying or selling.

2. Market Potential & Risks

A clear understanding of supply and demand metrics provides a glimpse into the market’s potential growth and inherent risks.

3. Future-Ready Investment

Historical data, when combined with external factors, offers foresight into potential future trends, allowing for proactive real estate investment.

With the Australian property landscape ever-evolving, staying updated and making sense of market analysis reports is indispensable. By breaking down the data and understanding its implications, beginners and seasoned investors alike can harness real estate insights, making the journey from mere data points to concrete, informed decisions.